With a loyal customer base, shops with indoor smoking lounges in Long Beach that sell fine cigars have seen a steady rise in sales in recent years thanks to an improving economy, while a few stores have carried on through a recent change in ownership.

A proposal to increase the state tobacco tax, however, may cut into profits for retailers and make the luxury item, most popular during special occasions and for relaxation, more expensive for consumers, say business owners and industry experts.

Albert Espinoza, owner of Taylor’s Cigar Lounge in Northeast Long Beach, said his business has seen a 10 percent increase in sales over the past year.

Albert Espinoza, owner of Taylor’s Cigar Lounge at 5937 E. Spring St., holds one of his premium house-blend cigars at his store, which he said is the oldest smoking lounge in Long Beach having been in business for 11 years. (Photograph by the Business Journal’s Evan Patrick Kelly)

“It’s not been substantial, but it’s good,” he said, adding that a younger crowd of college-age cigar smokers is now coming into the doors.

Espinoza opened up his cigar lounge a little more than 11 years ago on East Spring Street, replacing a gift shop that once sold cigars and tobacco.

He said his business is the oldest smoking lounge in Long Beach, noting that the shop, which offers two separate smoking lounges and a walk-in, glass-enclosed humidor lined with Spanish cedar wood for keeping cigars fresh, was opened before Long Beach passed new regulations on such businesses.

Out of public health concerns, the city council amended an ordinance in 2009, capping the number of indoor smoking lounges allowed to operate in the city at eight and imposing stricter ventilation requirements.

Two indoor smoking lounge permits are currently available after two lounges with permits closed in recent years, according to city officials.

City staff notes in an email sent to the Business Journal that only one citation was issued, in 2012, since the city’s new regulations have gone into affect. The city’s business license department has issued warning notices when violations have been found, but the violations were resolved in a “timely manner,” city officials said.

A major challenge fine cigar shops in California face is the threat of rising taxes on tobacco sales – that is, if proposed state legislation passes.

Senate Bill 591 has been introduced by Sen. Richard Pan (D-Sacramento) as a way to discourage smoking while raising money for Medi-Cal beneficiaries and smoking prevention plans. In a statement, Pan states California’s tobacco tax rate is currently among the lowest in the nation, adding that 32 other states have a higher tax rate.

The bill would increase taxes on cigarettes by $2 a pack. However, it would also indirectly increase the excise tax rate applied to cigars and other non-cigarette tobacco products, known as other tobacco products (OTP), according to an email from the California State Board of Equalization (BOE) sent to the Business Journal.

The current OTP tax rate as of July imposed on cigars is 28.1 percent of the wholesale cost. However, BOE staff “estimates” that, if SB 591 were to become law, the excise tax rate imposed on cigars and other OTPs would increase to 64.72 percent.

BOE officials explain that the tax rate for cigars is based on the wholesale cost at a tax rate equivalent to that imposed on cigarettes. The rate is determined by dividing the tax rate per cigarette by the average wholesale cost per cigarette.

State law requires BOE to determine the rate each year between March 1 and June 30. If SB 591 were to pass, the updated rate would take effect July 2016.

If the measure fails in the state legislature, supporters say they are prepared to take it to the November 2016 ballot, which would require a two-thirds vote and Gov. Jerry Brown’s signature. However, the tobacco industry has blocked similar attempts in the past.

Craig Williamson, president of the Cigar Association of America, Inc., a national trade organization advocating primarily for cigar manufacturers, said in a phone interview that such legislation, if passed, would likely negatively impact cigar retailers as cigars will likely become more expensive to buy in California.

“It’s so tough to do business now in the State of California and this will really devastate the mom and pop cigar stores that are out there,” he said.

In addition, the U.S. Food and Drug Administration (FDA) plans to release a new set of rules and regulations on manufacturers of all new tobacco related products, including fine cigars, that may end up hurting retail shops as well, Williamson said, who added that tobacco is mostly all grown overseas.

He said figures have shown the new regulations may add anywhere from $150,000 to $1 million in costs to manufacturers for getting a new tobacco product on the market, which could mean fewer new cigar brands may be available in the future.

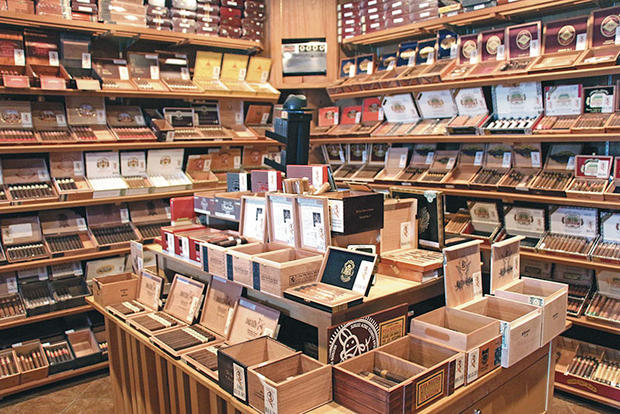

Taylor’s Cigar Lounge in East Long Beach offers a wide variety of premium cigars from manufacturers from all over the world at its walk-in, glass-enclosed humidor lined with Spanish cedar wood to keep cigars fresh. (Photograph by the Business Journal’s Evan Patrick Kelly)(Photograph by the Business Journal’s Evan Patrick Kelly)

Espinoza said such an increase in the excise tax rate would be “detrimental” to his business, especially since he now has to compete with online sellers as some customers are trying to bypass sales and excise taxes by purchasing cigars on the Internet.

A big boost in marketing, Espinoza said, however, has come from local festivals and events, where he has been able to sell his wide assortment of fine cigars as a vendor, even once providing cigars for the Playboy Mansion.

Josue Arauz, manager of Don Lupe Cigar Lounge, the latest establishment to receive an indoor smoking lounge permit when it took over a former cigar lounge on 2nd Street in Belmont Shore about three years ago, said he expects customers to continue buying cigars regardless if the tax rate increase passes.

“People keep on smoking,” he said. “They don’t stop. Customers will still put down the money.”

While health groups are pushing many of the taxes and regulations as anti-smoking campaigns because of tobacco products’ harmful health effects and addictive nature, fine cigar shop owners interviewed by the Business Journal said they don’t allow cigarette smoking or e-cigs in their lounges, adding that fine cigars are in a different class.

“It’s a different animal,” said Celeste Cummings, who recently took over ownership of Joe R’s Cigars on Broadway in Downtown Long Beach. She said fine cigars are hand rolled with quality tobacco and are meant for a brief hour or two of relaxation.

“With cigarettes, you have something that’s been chemically treated that you inhale into your lungs and it can be addictive as a result,” she said. “With cigars, it’s just tobacco. There are no additives. You don’t inhale it in your lungs. You really just hold it in your mouth and you blow out, so you don’t have the same challenges with lung cancer and some of the things that you have with cigarettes.”

Despite the proposed tax increases and regulations, Diana Choi, who took over ownership of Marquee Cigar Lounge on 2nd Street, said there is still a strong demand for fine cigars in Long Beach, adding that she was compelled to buy the shop because of its location that provides for a built-in clientele along the commercial corridor.

“It’s been great so far in the past few years,” Choi said. “I think it’s great that a lot of people can still grab a cigar and smoke on 2nd Street, which is rare nowadays.”